Avoid a cash flow crisis with these simple tips

Managing cash flow is crucial for small business owners. Even if your business is profitable, poor cash flow management can create significant challenges. In this guide, we’ll share practical tips to help you avoid a cash flow crisis and ensure your business remains financially healthy.

Understanding cash flow

Cash flow refers to the money moving in and out of your business. Cash inflows come from sales, interest earned, and investments. Cash outflows cover expenses like rent, payroll, bills, and supplier payments. Positive cash flow means your inflows exceed outflows, while negative cash flow indicates more money going out than coming in.

Why cash flow matters

You might ask, “Why is cash flow so important if my business is profitable?” The answer is simple: without sufficient cash on hand, you can’t pay your bills, invest in growth, or even keep the lights on. Understanding and managing your cash flow is essential to maintaining the health and stability of your business.

Tips to avoid a cash flow crisis

1. Manage your expenses

Regularly review your expenses and look for ways to cut costs. Can you negotiate better terms with suppliers? Are there subscriptions or services you no longer need? By keeping a close eye on your expenses, you can identify savings opportunities and reduce your outflows.

2. Encourage repeat business

It’s often cheaper and more effective to retain existing customers than acquire new ones. Offer loyalty programs, discounts, or incentives to encourage repeat business. Happy customers are more likely to return and recommend your business to others.

3. Invoice quickly and set shorter payment terms

The sooner you invoice, the sooner you’ll get paid. Implement a system to send invoices immediately after delivering goods or services. Consider setting shorter payment terms (e.g., Net 10 instead of 20th month following, or Net 30 instead of Net 60) to improve cash flow.

4. Don’t accept late payments

Late payments can severely impact your cash flow. Consider offering discounts for early payments or imposing penalties for late payments. Clear communication about payment terms and consistent follow-ups can help ensure timely payments.

5. Manage your inventory

Too much inventory ties up cash unnecessarily. Implement just-in-time inventory practices to order items only when needed. Regularly review your inventory levels and turnover rates to ensure you’re not overstocking slow-moving items.

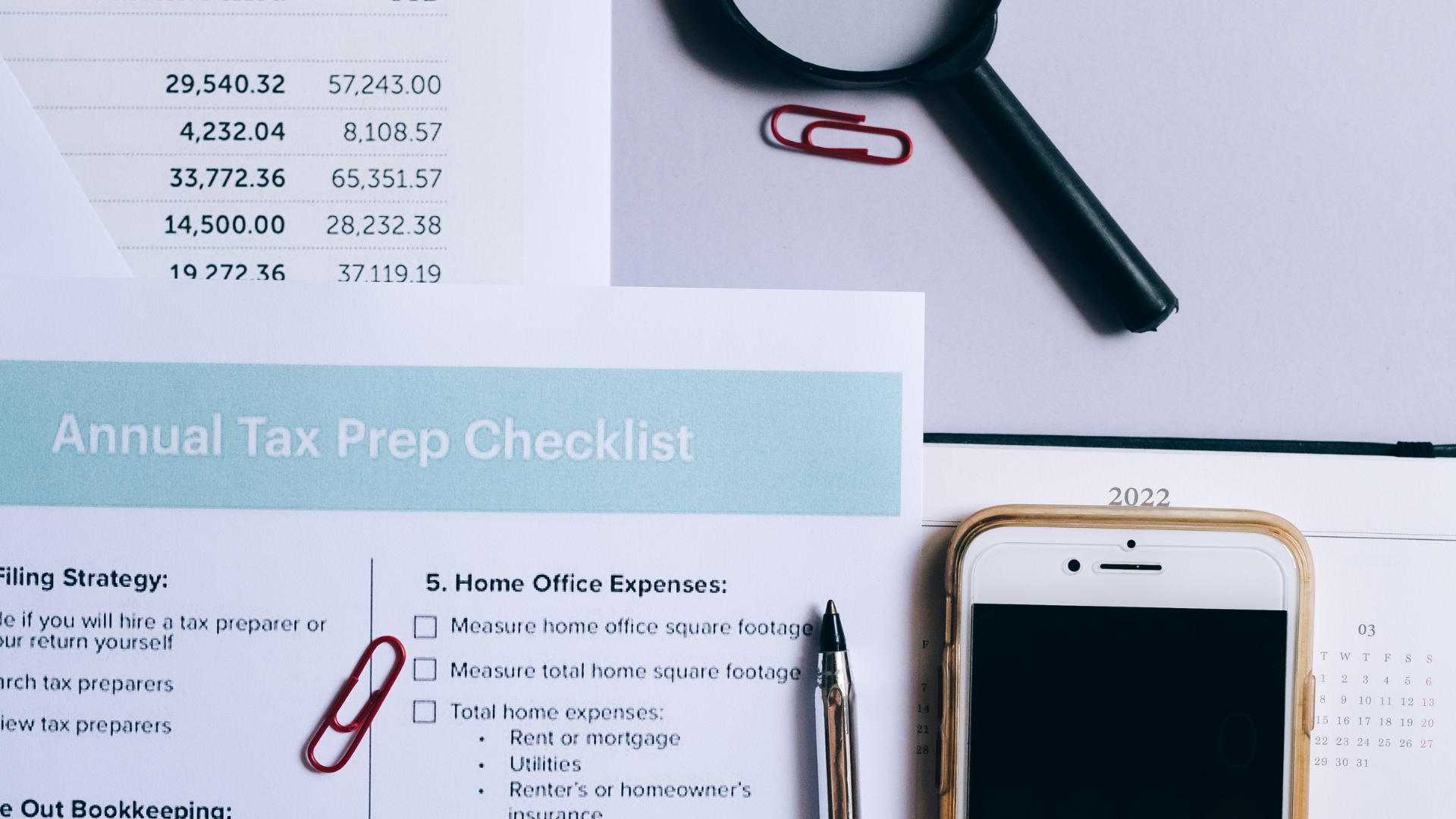

6. Cash flow forecasting

A cash flow forecast is a projection of your cash inflows and outflows over a specific period, usually 12 months. It helps you anticipate potential shortfalls and take corrective actions in advance. Regularly update your forecast to reflect changes in your business environment.

7. Build cash reserves

Having a cash reserve can help you weather unexpected expenses or downturns. Aim to save enough to cover at least three months of operating expenses. This financial cushion can provide peace of mind and stability during uncertain times.

8. Improve operational efficiencies

Look for ways to streamline your operations and reduce waste. Can you automate certain tasks? Are there more efficient methods or technologies you can adopt? Improved efficiencies can lead to cost savings and better cash flow management.

9. Explore multiple revenue streams

Diversifying your revenue streams can help level out your cash flow. If one source of income dries up, having others can keep your business afloat. Consider adding complementary products or services, or exploring new markets.

10. Negotiate with suppliers

Can your suppliers offer better payment terms or discounts for bulk purchases? Building strong relationships with your suppliers can lead to better terms that improve your cash flow. Don’t hesitate to negotiate and ask for what you need.

Final thoughts

Effective cash flow management is critical for the success of your small business. By following these practical tips, you can avoid a cash flow crisis and ensure your business remains financially healthy. Remember, a little proactive planning can go a long way in securing your business’s future.

We can help you with a cash flow forecast, and if you need advice or further assistance, feel free to reach out to our team. We’re here to help.