The importance of bookkeeping

As a business owner, you’ll need to stay informed about your finances and your financial situation. You do this through bookkeeping. Bookkeeping is the process of recording transactions in your business. This includes any transactions, credit card charges and any other financial activity that happens within your company.

How good bookkeeping helps you

Bookkeeping is vital for any business. First, it helps you understand your finances. Bookkeeping gives you insights into your income and expenses, such as:

- How much money you’ve made

- How much money needs to be paid for bills or salaries

- How much money should be put away for taxes or other unexpected costs

Bookkeeping also helps keep track of all your business transactions. A good system will serve as an audit trail showing every transaction that has taken place within your company. This includes purchases from suppliers, sales made to customers and bills paid out by suppliers or employees (like salaries).

If there are any irregularities such as missing items on purchase orders then this information will quickly become apparent. You get transparency into your business, a way to ensure you remain compliant with laws, and valuable insights to help you make smarter decisions.

When to hire a bookkeeper

There are many scenarios where it makes sense to hire a bookkeeper. These depend on your business set up and your own abilities.

You should consider hiring a bookkeeper if you have

- More than one employee

- Multiple business locations

- A complex business structure

- Concerns about making errors in your books that could lead to fines or penalties

- Too much work to do and bookkeeping constantly gets pushed to the side

- A lack of experience with bookkeeping and are uncertain about how to go about it, so you avoid it.

What a bookkeeper can provide for you

Expertise

Bookkeepers are experts at managing, sorting and recording your business’s financial transactions. They’ve spent time developing their skills and experience. During that time, they’ve also seen and resolved bookkeeping-related issues that you may come up against. Their expertise makes them more efficient at managing those issues.

Beyond that, they understand business trends and challenges others in your industry face, and can help you move through those as well. They also know what questions to ask to help you make important decisions and can share best practices with you.

Guidance

Your bookkeeper not only helps you maintain accurate records, they understand your financial circumstances. They help you assess how to make important business decisions, such as whether now is a good time to grow or when you should hold back. They can also identify trends in your industry and help you take advantage of those opportunities.

Finally, they can assist you with budgeting, and sticking to your budget. They’ll help you come up with a realistic financial plan that enables your business to grow while achieving short- and long-term goals.

Time savings

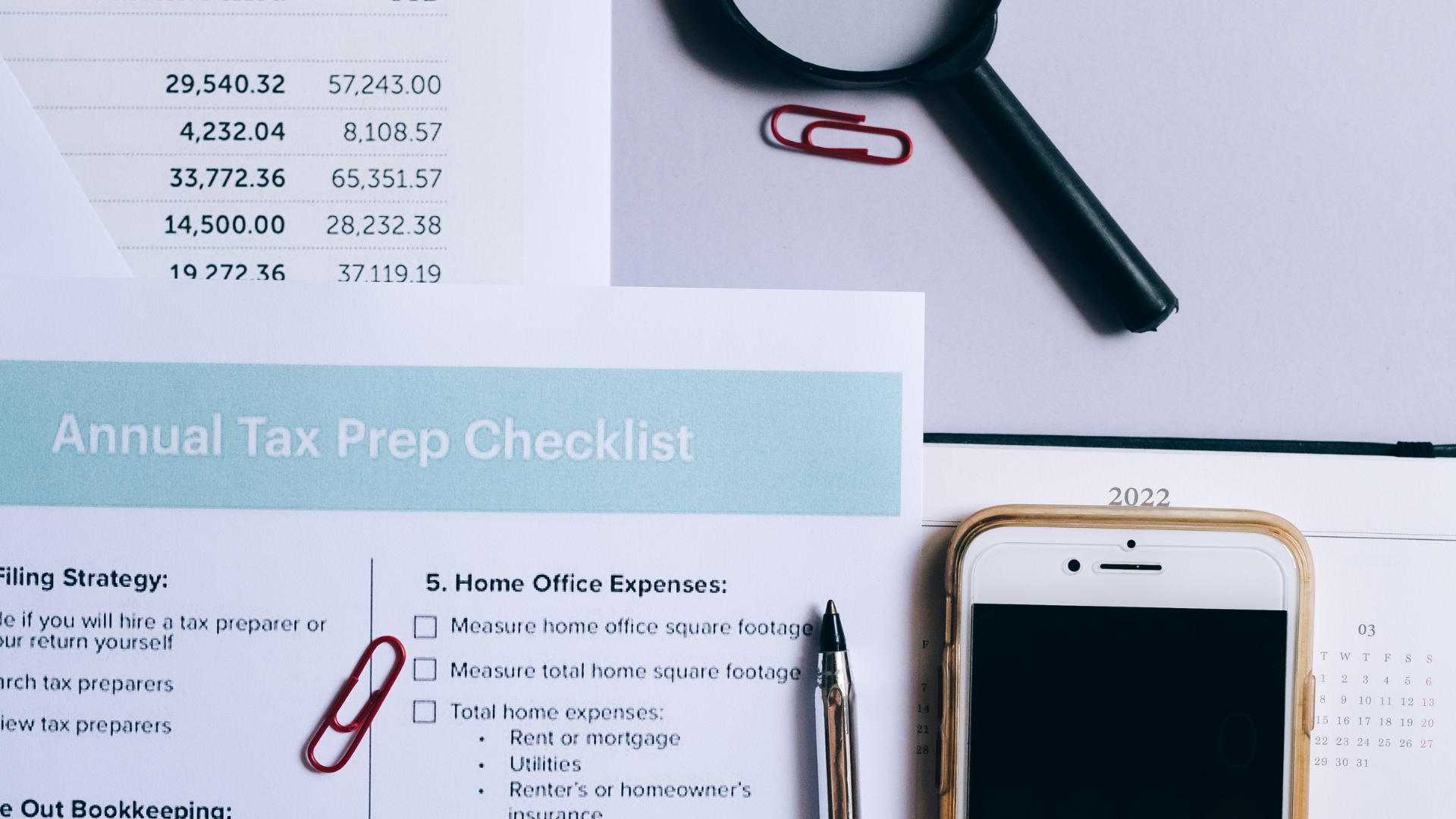

As a business owner, you likely have many activities to focus on. In bookkeeping alone there are numerous tasks to be responsible for, such as:

- Collecting and recording transaction data

- Sorting receipts

- Classifying expenses

- Invoicing customers

- Paying vendors

- Managing payroll.

Bookkeepers take on those tasks so you don’t have to. It’s not just about the energy you put into them, it’s about the fact that unless you’re an expert at bookkeeping, it’ll likely take you longer to complete these activities than it would take a bookkeeper. That can add up to a lot of extra hours.

By hiring a bookkeeper, you save yourself that valuable time for other activities such as marketing, perfecting your products or even spending time with family.

Money savings

There’s a time cost to doing your own books, but there’s also a potential money cost in the form of missed opportunities. The time you spend doing your own books is time you could potentially be out creating or taking advantage of new opportunities for your business. Your bookkeeper frees you up so you have the time and energy to identify potential opportunities. They can also advise you on whether you’re in a good financial position to jump on those possibilities.

Additionally, the expertise bookkeepers bring to their activities means they’re likely to save you from costly mistakes that could affect your finances.

Final thoughts

There are many good reasons to hire a bookkeeper. Whether you do it on your own or hire someone, bookkeeping is an essential part of running a successful business. If you’d like to learn more about how we can help you, contact us today for more information.